Duties Owed to Clients

CFP Board has developed a series of Frequently Asked Questions (FAQs) concerning CFP Board’s Code and Standards as a resource to CFP® professionals and their firms.

Last Updated:

Questions

No. The new Code and Standards requires a CFP® professional to act as a fiduciary when providing “Financial Advice to a Client.” (See Standard A.1.) The Glossary defines a “Client” as any person to whom the CFP® professional “provides or agrees to provide Professional Services pursuant to an Engagement.” An “Engagement” is an “oral or written agreement, arrangement, or understanding.” Therefore, unless there is an agreement, arrangement, or understanding that the CFP® professional will be providing professional services, the person receiving the information is not a “Client,” and the CFP® professional does not have a fiduciary duty to that person.

In addition, the Glossary defines “Financial Advice” as “a communication that, based on its content, context, and presentation, would reasonably be viewed as a recommendation that the Client take or refrain from taking a particular course of action.” In the scenarios outlined in this question, it would be unreasonable for the CFP® professional, the cocktail party guest, or the relative to assume that they have established a client relationship, or that the information was a purposefully directed recommendation to take a specific action.

Furthermore, the definition of Financial Advice indicates that the “more individually tailored the communication” is to the information recipient, the “more likely the communication will be viewed as Financial Advice.” A CFP® professional’s general opinions about a particular company or the benefits of opening a 529 college savings plan would not be viewed as being tailored to the specific needs of that particular information recipient, and thus, would not constitute Financial Advice.

Finally, CFP Board applies an objective standard, not a subjective standard, to determine whether a particular communication constitutes Financial Advice. Therefore, in determining whether a CFP® professional has a fiduciary duty, CFP Board will consider whether “a reasonable CFP® professional” would conclude that the communication constituted Financial Advice, and will not defer to the opinion of either that particular information recipient or the CFP® professional who made that communication. (Originally Published: November 27, 2018)

Financial Advice has a much broader scope than Financial Planning. The new Code and Standards states that a CFP® professional provides Financial Planning “through” Financial Advice. While Financial Planning requires Financial Advice, not all Financial Advice requires Financial Planning.

The new Code and Standards sets forth separate definitions for Financial Advice and Financial Planning. The Glossary defines Financial Advice as:

A. A communication that, based on its content, context, and presentation, would reasonably be viewed as a recommendation that the Client take or refrain from taking a particular course of action with respect to:

- The development or implementation of a financial plan;

- The value of or the advisability of investing in, purchasing, holding, gifting, or selling Financial Assets;

- Investment policies or strategies, portfolio composition, the management of Financial Assets, or other financial matters;

- The selection and retention of other persons to provide financial or Professional Services to the Client; or

B. The exercise of discretionary authority over the Financial Assets of a Client.

The determination of whether Financial Advice has been provided is an objective rather than subjective inquiry. The more individually tailored the communication is to the Client, the more likely the communication will be viewed as Financial Advice. The provision of services or the furnishing or making available of marketing materials, general financial education materials, or general financial communications that a reasonable person would not view as Financial Advice, does not constitute Financial Advice.

The new Code and Standards defines Financial Planning in the Glossary as follows:

Financial Planning is a collaborative process that helps maximize a Client’s potential for meeting life goals through Financial Advice that integrates relevant elements of the Client’s personal and financial circumstances.

The new Code and Standards also identifies factors (See Standard B.4.) that CFP Board will weigh in determining whether a CFP® professional providing Financial Advice is required to provide Financial Planning, and thus is required to comply with the Practice Standards. These integration factors are discussed in another FAQ. Where application of those factors to a particular situation leads to the conclusion that Financial Planning is not required, the new Code and Standards does not require a CFP® professional to comply with the Practice Standards. (See Standard C.) In that circumstance, the CFP® professional remains obligated to act as a fiduciary when providing Financial Advice to a Client. (See Standard A.1.) As noted above, since Financial Planning requires Financial Advice, a CFP® professional also must act as a fiduciary at all times when providing Financial Planning to a Client. (Originally Published: November 27, 2018)

The new Code and Standards sets forth an objective standard requiring a CFP® professional providing Financial Advice to act in the best interests of the Client. In order to act in the best interests of the Client, a CFP® professional must fulfill a Duty of Loyalty, a Duty of Care, and a Duty to Follow Client Instructions. Standard A.1 of the new Code and Standards defines each of these duties using language that was drawn from the common law of fiduciaries.

The Duty of Loyalty requires a CFP® professional to:

i. Place the interests of the Client above the interests of the CFP® professional and the CFP® Professional’s Firm;

ii. Avoid Conflicts of Interest, or fully disclose Material Conflicts of Interest to the Client, obtain the Client’s informed consent, and properly manage the conflict; and

iii. Act without regard to the financial or other interests of the CFP® professional, the CFP® Professional’s Firm, or any other individual or entity other than the Client, which means that a CFP® professional acting under a Conflict of Interest continues to have a duty to act in the best interests of the Client and place the Client’s interests above the CFP® professional’s.

Disclosure of Material Conflicts of Interest by itself is not sufficient to fulfill the Duty of Loyalty.

The Duty of Care requires a CFP® professional to act with the care, skill, prudence, and diligence that a prudent professional would exercise in light of the Client’s goals, risk tolerance, objectives, and financial and personal circumstances.

The Duty to Follow Client Instructions requires a CFP® professional to comply with all objectives, policies, restrictions, and other terms of the Engagement and all reasonable and lawful directions of the Client. (Originally Published: November 27, 2018)

Yes. When a CFP® professional provides Financial Advice to a Client, the CFP® professional is required to act as a fiduciary regardless of whether the advice is one time or ongoing. A CFP® professional who provides a one-time recommendation and has no ongoing duty to monitor or provide other Financial Advice concerning the recommendation does not have an ongoing Fiduciary Duty with respect to that recommendation. A CFP® professional who provides ongoing Financial Advice is subject to an ongoing Fiduciary Duty. The Fiduciary Duty in the Code and Standards provides that a CFP® professional must act as a fiduciary, and therefore, act in the best interests of the Client, at all times when providing Financial Advice to a Client. Financial Advice includes, among other things, a communication that, based on its content, context, and presentation, would reasonably be viewed as a recommendation that the Client take or refrain from taking action with respect to the value of or advisability of investing in, purchasing, holding, gifting, or selling assets. (Originally Published: January 16, 2020)

CFP Board’s Duty to Disclose and Manage Conflicts of Interest, which is set forth in Standard A.5 of the new Standards of Conduct requires a CFP® professional to fully disclose all Material Conflicts of Interest that could affect the professional relationship and provide sufficiently specific facts so that a reasonable Client would be able to understand the Material Conflicts of Interest and the business practices that give rise to the conflicts and give informed consent to such conflicts or reject them. As indicated in the Glossary, a “Conflict of Interest” arises when:

- A CFP® professional’s interests (including the interests of the CFP® Professional’s Firm) are adverse to the CFP® professional’s duties to a Client; or

- A CFP® professional has duties to one Client that are adverse to another Client.

A Conflict of Interest becomes “Material” when a “reasonable Client or prospective Client would consider the information” about the conflict to be “important in making a decision” about the engagement with the CFP® professional, such as whether to retain, or continue to retain, a CFP® professional or whether to implement a recommendation.

In determining whether the disclosure about a Material Conflict of Interest provided to the Client was sufficient to infer that a Client has consented to a Material Conflict of Interest:

CFP Board will evaluate whether a reasonable Client receiving the disclosure would have understood the conflict and how it could affect the advice the Client will receive from the CFP® professional. The greater the potential harm the conflict presents to the Client, and the more significantly a business practice that gives rise to the conflict departs from commonly accepted practices among CFP® professionals, the less likely it is that CFP Board will infer informed consent absent clear evidence of informed consent. Ambiguity in the disclosure provided to the Client will be interpreted in favor of the Client.

Whether a Client has provided informed consent depends on the facts and circumstances and may be inferred when not explicit. For example, silence after disclosure may constitute informed consent if the disclosure contains sufficiently specific facts that are understandable to a reasonable Client, but may not constitute informed consent if that is not the case. CFP Board intends for its “informed consent” standard to be interpreted in a manner that is consistent with interpretations of the Investment Advisers Act of 1940. A CFP® professional may refer to regulatory guidance and case law interpretations to gain a deeper understanding of “informed consent.”

CFP Board recognizes that, in some circumstances, there are logistical challenges to providing written disclosure of Material Conflicts of Interest. Therefore, the standard does not require either the CFP® professional’s disclosure or the Client’s consent to be in writing. However, the standard also makes clear that evidence of oral disclosure of a conflict will be given such weight as CFP Board in its judgment deems appropriate.

In view of the fact-intensive nature of an inquiry into whether a CFP® professional orally disclosed a conflict, and whether a Client provided informed consent, a CFP® professional operating under a Material Conflict of Interest may want to consider, among other things, (a) avoiding business practices that create Material Conflicts of Interest that are difficult to manage, (b) describing all Material Conflicts of Interest to a Client clearly and in a manner that will allow the Client to understand the conflict, and (c) obtaining written consent to those Conflicts of Interest that a reasonable CFP® professional would consider adverse to the Client’s interests.

A CFP® professional acting under a Conflict of Interest continues to have a duty to act in the best interests of the Client and place the Client’s interests above the interests of the CFP® professional.

Disclosure of Material Conflicts of Interest does not eliminate the Duty of Loyalty or the Duty of Care. (Originally Published: November 27, 2018)

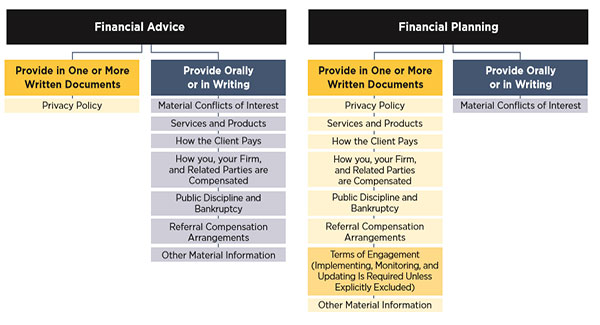

A CFP® professional has a Duty to Provide Information to a Client. Whether the information may be provided orally or must be provided in writing depends upon whether the Financial Advice that the CFP® professional is providing requires Financial Planning.

There are eight categories of information that a CFP® professional is required to provide to a Client when providing Financial Advice. There is an additional category of information that a CFP® professional must provide to a Client when providing or required to provide Financial Planning in accordance with the Practice Standards. (Standard A.10.) The requirement to provide information to a Client set forth in CFP Board’s Code and Standards is in addition to any requirements that apply under applicable law, rule, or regulation and the CFP® Professional’s Firm’s policies and procedures.

When Providing Financial Advice: When providing Financial Advice, a CFP® professional is required to provide the following information to the Client:

- A description of the services and products to be provided;

- How the Client pays for the products and services, and a description of the additional types of costs that the Client may incur, including product management fees, surrender charges, and sales loads;

- How the CFP® professional, the CFP® Professional’s Firm, and any Related Party are compensated for providing the products and services;

- The existence of any public discipline or bankruptcy, and the location(s), if any, of the webpages of all relevant public websites of any governmental authority, self-regulatory organization, or professional organization that sets forth the CFP® professional’s public disciplinary history or any personal bankruptcy or business bankruptcy where the CFP® professional was a Control Person;

- Full disclosure of all Material Conflicts of Interest with the CFP® professional’s Client that could affect the professional relationship (a CFP® professional also must obtain the Client’s informed consent and adopt and follow business practices reasonably designed to prevent Material Conflicts of Interest from compromising the CFP® professional’s ability to act in the Client’s best interests);

- Written notice of policies regarding the protection, handling, and sharing of a client’s non-public personal information (Privacy Policies);

- Any arrangement by which someone who is not the Client will compensate or provide some other material economic benefit to the CFP® professional, the CFP® Professional’s Firm, or a Related Party for engaging or recommending the selection or retention of additional persons to provide financial or Professional Services for a Client; and

- Any other information about the CFP® professional or the CFP® Professional’s Firm that is Material to a Client’s decision to engage or continue to engage the CFP® professional or the CFP® Professional’s Firm.

When Providing Financial Planning: When providing or required to provide Financial Planning in accordance with the Practice Standards, in addition to the information described above, a CFP® professional must provide to the Client the terms of the Engagement between the Client and the CFP® professional or the CFP® Professional’s Firm. The terms of the Engagement include the Scope of Engagement and any limitations, the period(s) during which the services will be provided, and the Client’s responsibilities. (Note that a CFP® professional is responsible for implementing, monitoring, and updating the Financial Planning recommendation(s) unless specifically excluded from the Scope of Engagement.)

Orally or in Writing? The chart set forth below summarizes the categories of information that a CFP® professional must provide a Client, and whether a CFP® professional must provide the information orally or in writing:

A CFP® professional must document that the information has been provided to the Client. CFP Board does not require any particular form of documentation. For example, a CFP® professional may document the information in a CRM or by maintaining a copy of an email sent to the Client. A CFP® professional also has an ongoing obligation to provide the Client with any information that is a Material change or update. Material changes and updates to public disciplinary history or bankruptcy information must be disclosed to the Client within 90 days, together with the location(s) of any relevant webpages. (Standard A.10.c.) (Originally Published: January 16, 2020)

Maybe. A CFP® professional investment adviser representative who provides a Form ADV Brochure and Brochure Supplement that contains only the information that the Brochures require would not fully satisfy the Duty to Provide Information to a Client. However, a CFP® professional investment adviser representative may satisfy the Duty to Provide Information to a Client by providing a Client a Form ADV Brochure and Brochure Supplement (including Form CRS) that contains all the information that the standard requires. (Originally Published: January 16, 2020)

Maybe. A CFP® professional investment adviser representative who provides a Form ADV Brochure and Brochure Supplement that contains only the information that the Brochures require would not fully satisfy the Updating Information component of the Duty to Provide Information to a Client. However, a CFP® professional will satisfy the Duty to Provide Information to a Client by delivering to a Client a Brochure (and/or Brochure Supplement) that contains all the required information listed in Standard A.10. To satisfy the Updating Information requirement, a CFP® professional must provide to the Client any information that is a Material change or update to the information that the Code and Standards requires a CFP® professional to provide to the Client. Between annual updating amendments to Form ADV, the SEC requires disclosure of Material changes to such information to Clients even if those changes do not trigger delivery of an interim amendment.

However, Material changes and updates to public disciplinary history or bankruptcy information, which a CFP® professional must provide to the Client under the Code and Standards, but which Form ADV does not require to be disclosed, must be provided within ninety (90) days of the public discipline or bankruptcy, together with the location(s) of relevant webpages. (Originally Published: January 16, 2020)

A CFP® professional is required to satisfy the Duty to Provide Information to a Client set forth in Standard A.10. of the new Code of Ethics and Standards of Conduct. As part of the transition to the new Code and Standards, CFP Board is taking into consideration the fact that CFP® professionals already have provided information to existing Clients that is similar to the information that is required under the new Code and Standards. Therefore, a CFP® professional will not be required to make new disclosures to current Clients to the extent the CFP® professional has made all required disclosures under the previous Standards of Professional Conduct and there are no material changes or updates to the information required to be provided to the Clients. However, material changes and updates to disciplinary history or bankruptcy information must be disclosed to existing Clients within 90 days, together with the location(s) of the relevant webpages. With respect to new clients, the CFP® professional must provide the information identified in Standard A.10. of the new Code and Standards prior to or at the time of the Engagement. (Originally Published: January 16, 2020)

Maybe. Where the Client has indicated a preference for a particular form of delivery, the CFP professional must provide the information using the form of delivery the Client has requested. Where the client has not indicated a preference and if the Client has an email address that the CFP® Professional uses to communicate with the Client, then the CFP® professional may deliver the information to the Client using that email address. However, a Client must explicitly consent to the email delivery of personal financial data. A CFP® professional also should review the CFP® Professional’s Firm’s policies and procedures, which may address the delivery of information to a Client by email.

If the CFP® professional communicates with the Client by email, then a CFP® professional may satisfy the delivery requirement by electronically delivering to a Client an email that contains a location to the webpage link or URL to the information that has been posted on a website. The email must describe the information the Client may obtain by clicking on the link.

On the other hand, simply posting the information on a website, without taking these additional steps to direct the client to the information, would not satisfy the requirement that information be “provided to” a Client.

A CFP® professional who uses email delivery also must have reason to believe that information was successfully delivered to the Client.

The Duty to Provide Information to a Client requires a CFP® professional to document that the information was provided to the Client. For example, a CFP® professional may document the information in a CRM or by maintaining a copy of an email sent to the Client. (Originally Published: January 16, 2020)

CFP Board’s Duty to Provide Information to a Client is set forth in Standard A.10. of the Code and Standards. Standard A.10.a. requires CFP® professionals to provide certain information to a Client, prior to or at the time of the Engagement, when providing or agreeing to provide Financial Advice, and to document that the information has been provided to the Client. Among the information required to be provided pursuant to Standard A.10.a. is any “information about the CFP® professional or the CFP® Professional’s Firm that is Material to a Client’s decision to engage or continue to engage the CFP® professional or the CFP® Professional’s Firm.” See Standard A.10.a.viii.

With respect to investment adviser firms and their reporting obligations regarding PPP loans under the Investment Advisers Act of 1940, the staff of the U.S. Securities and Exchange (“SEC”) stated:

As a fiduciary under federal law, you must make full and fair disclosure to your clients of all material facts relating to the advisory relationship. If the circumstances leading you to seek a PPP loan or other type of financial assistance constitute material facts relating to your advisory relationship with clients, it is the staff’s view that your firm should provide disclosure of, for example, the nature, amounts and effects of such assistance.

See Question II.4., SEC, Division of Investment Management Coronavirus (COVID-19) Response FAQs, available at https://www.sec.gov/investment/covid-19-response-faq (emphasis added).

Similarly, CFP® professionals may be required to provide information about a PPP loan or loan forgiveness to Clients under the Code and Standards. If information about a PPP loan or loan forgiveness would be Material to a Client’s decision to engage or continue to engage the CFP® professional or the CFP® Professional’s Firm, it must be provided to the Client, prior to or at the time of the Engagement, pursuant to Standard A.10.a.viii.

CFP Board also reminds CFP® professionals that proceeds of PPP loans should only be used for the limited purposes enumerated by the SBA. (Originally Published: June 29, 2020)

The new Code and Standards sets a new standard for the use of fee-based – a term that is equivalent to “fee and commission,” but is often confused with fee-only. The standard provides that a CFP® professional who represents his or her compensation method as fee-based must not use the term in a manner that suggests the CFP® professional or the CFP® Professional’s Firm is fee-only. Moreover, a CFP® professional using fee-based must clearly state either that the CFP® professional earns both fees and commissions or is not fee-only. This standard also applies to other similar terms that, like fee-based, may be confused with a fee-only compensation method. (Originally Published: November 27, 2018)

CFP Board has defined the previously undefined term “Related Party” as including anyone whose receipt of Sales-Related Compensation reasonably would be viewed as directly or indirectly benefiting the CFP® professional or the CFP® Professional’s Firm. CFP Board will presume that family members and controlled business entities are Related Parties, but a CFP® professional may show otherwise. Sales-Related Compensation received by a Related Party only is relevant for purposes of fee-only if the compensation is received “in connection with any Professional Services the CFP® professional or CFP® Professional’s Firm provides to Clients.” This connection exists when the compensation results, directly or indirectly, from Client transactions referred (or facilitated) by the CFP® professional or the CFP® Professional’s Firm. For example, if a CFP® professional’s father is a broker who receives Sales-Related Compensation, but there is no connection between the father’s business and the CFP® professional’s business, the father’s Sales-Related Compensation is not being received “in connection with” the CFP® professional’s Professional Services. In this circumstance, the father’s Sales-Related Compensation would not prevent the CFP® professional from having a fee-only compensation method.

CFP Board also has a standard for using the term “fee-based.” A CFP® professional’s duty when using the term “fee-based” is discussed in another FAQ. (Originally Published: November 27, 2018)

The standard with respect to when a CFP® professional may use the term fee-only remains largely the same. The standard defines the term fee-only by exclusion, and identifies individuals and entities whose compensation should be considered in determining whether fee-only is an appropriate compensation representation. A CFP® professional may describe his or her or the CFP® Professional’s Firm’s compensation method as fee-only only where: (a) the CFP® professional and the CFP® Professional’s Firm receive no Sales-Related Compensation; and (b) Related Parties receive no Sales-Related Compensation in connection with any Professional Services the CFP® professional or the CFP® Professional’s Firm provides to Clients. “Sales-Related Compensation” and “Related Parties” are defined terms that are discussed in other FAQs. CFP Board replaced the term “commissions” with Sales-Related Compensation because there are some fees that, like commissions, provide an incentive for the purchase or sale of Financial Assets (such as 12b-1 fees). (Originally Published: November 27, 2018)

Sales-Related Compensation is more than a de minimis economic benefit, including any bonus or portion of compensation, resulting from a Client purchasing or selling Financial Assets. To account for compensation that is based on a Client’s decision to hold an asset, such as an incentive to advise a Client to annuitize a pension rather than take a lump sum, the Sales-Related Compensation definition also includes compensation resulting from a Client “holding” Financial Assets for purposes other than receiving Financial Advice. Sales-Related Compensation also includes compensation for the referral of a Client to any person or entity other than the CFP® Professional’s Firm, as the referral constitutes a Professional Service provided to a Client. The standard sets forth common examples of Sales-Related Compensation and explicitly excludes five types of compensation from the definition. (Originally Published: November 27, 2018)

Standard 12.f provides a standard for when the CFP® Professional’s Firm makes compensation representations that are inconsistent with CFP Board’s Code and Standards. If the CFP® professional Controls the firm, the CFP® professional must not allow the firm to make a representation of compensation method that would be false or misleading if made by the CFP® professional. For example, when a CFP® professional is the sole owner of a firm that refers to its compensation method as fee-only, but the CFP® professional personally sells insurance and securities in exchange for Sales-Related Compensation, the Code and Standards would not permit the CFP® professional to allow the CFP® Professional’s Firm, which the CFP® professional Controls, to use fee-only because the CFP® professional earns Sales-Related Compensation.

If the CFP® professional does not Control the firm, the CFP® professional does not have an obligation to prevent the firm from making a false or misleading misrepresentation of compensation method. Instead, the CFP® professional must correct any misrepresentation of compensation method by accurately representing the CFP® professional’s compensation method to the CFP® professional’s Clients. For example, assume a CFP® professional is an employee at a corporation that refers to its compensation method as fee-only even though the CFP® professional and others in the corporation refer commission-earning insurance business to a Related Party. In this instance, the CFP® professional could not use the term fee-only. Therefore, the CFP® professional must inform Clients that his or her compensation method is fee and commission. (Originally Published: November 27, 2018)

When a CFP® professional provides Financial Advice, the CFP® professional must inform the client how the CFP® professional, the CFP® Professional’s Firm, and any Related Party are compensated for providing the products and services. A CFP® professional also must not make false or misleading representations regarding the method of compensation of the CFP® professional or the CFP® Professional’s Firm. Standard A.12 of the new Code and Standards addresses two specific compensation representations (fee-only and fee-based), defines important terms, provides a safe harbor for related parties, and sets forth a standard that applies to misrepresentations by a CFP® Professional’s Firm. (Originally Published: November 27, 2018)

The new Code and Standards includes a Related Party compensation “safe harbor” for a CFP® professional who adopts and implements policies and procedures (including through a CFP® Professional’s Firm) reasonably designed to prevent recommendations that a Client purchase Financial Assets from or through, or refer any Clients to, a Related Party. (Originally Published: November 27, 2018)

The Fiduciary Duty in the Code and Standards provides that at all times when providing Financial Advice to a Client, a CFP® professional must act as a fiduciary, and therefore, act in the best interests of the Client. A recommendation that a Client select and retain another financial or Professional Services provider for a Client, such as an accountant or attorney, is Financial Advice. To fulfill that Fiduciary Duty, the Duties When Recommending, Engaging, and Working with Additional persons, set forth in Standard A.13.a.i. of the Code and Standards, requires a CFP® professional to have a reasonable basis for the recommendation based on the person’s reputation, experience, and qualifications.

A CFP® professional may obtain such a reasonable basis through appropriate due diligence to support the recommendation. The necessary amount of research and analysis will depend upon the facts and circumstances. A CFP® professional’s reliance upon a personal relationship with the other financial or Professional Services provider, by itself, ordinarily would be insufficient justification for the recommendation. Some of the information that a CFP® professional may consider reviewing when conducting due diligence includes information about the individual that is contained in FINRA’s BrokerCheck, the Investment Adviser Public Disclosure database, CFP.net/verify, CPAverify.org, and a Google search result. A CFP® professional also may rely upon the CFP® Professional’s Firm’s recommendation if the CFP® professional has a reasonable basis to believe that the firm developed the recommendation after conducting appropriate due diligence. (Originally Published: January 16, 2020)

Read more FAQs

These FAQs are part of a full library of resources that CFP® professionals can use to comply with the Code and Standards. More guidance materials can be found in our Compliance Resources Library.