Interpreting the Practice Standard for Analyzing the Client’s Current Course of Action

CFP Board has developed a series of case studies to provide practical guidance to CFP® professionals and their firms on the new Code and Standards. Each case study presents a hypothetical factual circumstance and then asks a question about a CFP® professional’s duty in that circumstance under the Code and Standards.

Joe, a CFP® professional, meets with Martha and Dan Miller, who are 32 years old and have a newborn daughter. Joe learns the following about the Millers:

Age, Income, Dependents

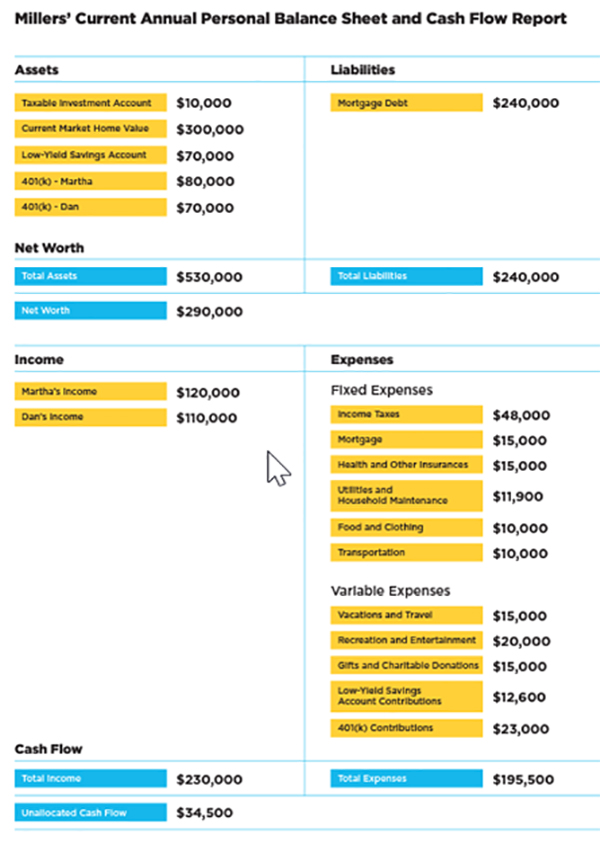

- Martha and Dan have annual salaries of $120,000 and $110,000, respectively.

- The Millers contribute $12,600 annually to a savings account that has a balance of $70,000, which includes $30,000 for emergencies, $30,000 targeted for the purchase of a lake cabin, and $10,000 earmarked for college savings.

- They have a taxable investment account with a $10,000 value.

- The allocation in their accounts is 50% equities and 50% fixed income.

- Marth and Dan have $34,500 in unallocated cash flow each year.

- Martha and Dan contribute 10% of their salaries (with a 6% employer match) to their 401(k) plan accounts, which collectively have a value of $150,000.

- They have employer-provided life insurance coverage that is equal to two times their salaries.

- Marth and Dan’s home value is $300,000 with $60,000 of equity.

- They have not created any estate planning documents.

Savings, Assets, Liabilities, Education and Retirement Accounts

Expenses, Cash Flow, Liquidity

Insurance, Employee Benefits

Estate Plans

Joe helps Martha and Dan identify and select five goals:

- Accumulate adequate retirement assets to retire at age 67 and live a comfortable life during retirement.

- Acquire a cabin at the lake within approximately six years.

- Have adequate insurance coverage.

- Create an estate plan.

- Accumulate assets to cover their daughter’s elite private university costs.

QUESTION:

In analyzing the current course of action under Step 3 of the Financial Planning Process, what else must Joe do?

Response A-B are not the best response because each present only one material advantage or disadvantage of their current course of action. There is additional analysis that Joe must perform to satisfy this step of the Financial Planning process. Response A also addresses a component of Step 4 of the Financial Planning process; namely, the development of a recommendation. A CFP® professional, however, does not develop recommendations until Step 4 of the Financial Planning process. Before developing recommendations, a CFP® professional must analyze potential alternative courses of action.

Response A-B are not the best response because each present only one material advantage or disadvantage of their current course of action. There is additional analysis that Joe must perform to satisfy this step of the Financial Planning process. Response A also addresses a component of Step 4 of the Financial Planning process; namely, the development of a recommendation. A CFP® professional, however, does not develop recommendations until Step 4 of the Financial Planning process. Before developing recommendations, a CFP® professional must analyze potential alternative courses of action.

Response C is not the best response. As discussed in the analysis of Responses A and B, a CFP® professional does not develop recommendations until Step 4 of the Financial Planning process.

Response D is the best response. This case study involves Step 3 of the Financial Planning Practice Standards (Standard C.3.)

Step 3 of the Financial Planning Practice Standards has two components: (1) analyzing the Client’s current course of action and (2) analyzing potential alternative courses of action. In fulfilling the first component, a CFP® professional must analyze the Client’s current course of action, including the material advantages and disadvantages of the current course and whether the current course maximizes the potential for meeting the Client’s goals.

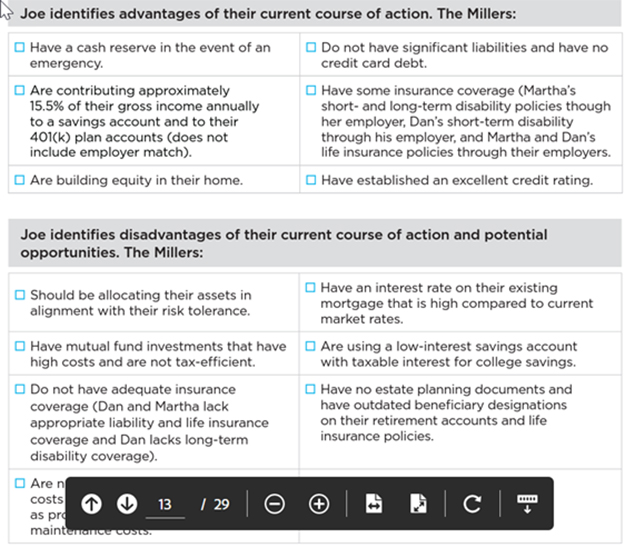

Response D is the best response because it presents a more comprehensive list of the additional analysis that Joe must perform than that which is presented in Responses A and B. In analyzing their savings rate, liabilities, investment allocation, and retirement projections, Joe would need to consider the material advantages and disadvantages to determine whether the Millers are maximizing the potential to meet their goals. After performing this analysis, Joe determines as follows:

Joe’s analysis of the Millers’ current course shows a low likelihood of meeting all their targeted goals. Joe begins to analyze potential alternative courses of action, each of which helps maximize the potential for the Millers to meet their goals and integrates the relevant elements of the Millers’ personal and financial circumstances.

Relevant Standards and Definitions: Practice Standards for the Financial Planning Process, Step 3: Analyzing the Client’s Current Course of Action and Potential Alternative Course(s) of Action (Standard C.3.)

Access More Guidance Materials

This compliance resource is part of a full library of resources that CFP® professionals can use to comply with the Code and Standards. More guidance materials can be found in our Compliance Resources Library.