CFP® Certification: More Important in Today’s World Than Ever Before

The profession’s expansion comes at a critical time to meet high consumer demand for financial planning.

In October, the financial planning industry celebrated its fourth annual World Financial Planning Day, and last December, the profession turned 50 years old with no signs of slowing down.

As we near the end of 2020, the number of CFP® professionals in the United States has grown to more than 87,000 — an increase of 27% since 2013, when there were just under 70,000. Across the globe at the end of 2019, according to the Financial Planning Standards Board Ltd., there were nearly 190,000 CFP professionals spanning 27 countries and territories — an increase of 23% since 2013. This growth is expected to increase further in the coming years.

The profession’s expansion has come at a critical time to meet high consumer demand for financial planning — a demand that only has intensified with the economic uncertainty generated by the COVID-19 pandemic.

Financial Planning Meets the COVID-19 Moment

Since the pandemic’s emergence in March, the stress and anxiety of Americans have reached high levels. An April survey conducted by CFP Board to assess the impact of the pandemic on our CFP® professionals and their clients found that 64% of CFP® professionals said their clients are experiencing high or very high levels of stress as a result of the outbreak.

According to an April survey conducted by Nationwide Financial, 1 in 4 Americans said they were seeking the help of a financial advisor for the first time ever due to the impact of the pandemic.

This environment has caused a surge in client inquiries — the April CFP Board study found that 78% reported an increase in client inquiries in the first 30 days of the pandemic. It has even led to an emergence in demand among those who traditionally have eschewed financial advice. ThinkAdvisor has highlighted that “many prospective clients have begun to realize the value of having a comprehensive financial plan, one that can endure unexpected obstacles, like a pandemic.” According to an April survey conducted by Nationwide Financial, 1 in 4 Americans said they were seeking the help of a financial advisor for the first time ever due to the impact of the pandemic.

Consumers seeking advisors are looking for more than just investment advice. In 2018, research firm Cerulli Associates found that 64% of advisors reported that client demand for financial planning is increasing overall. As more investors recognize the importance of financial planning and take action to develop their own plans, they’ll be in a better position to continue to weather this downturn (however long it lasts). Nine in ten of the CFP® professionals surveyed by CFP Board in April agreed that Americans with a financial plan are more likely to make progress toward their goals, even during times of economic uncertainty.

Smart Career: High Satisfaction and Compensation Growth Opportunities

In this time when the counsel of a CFP® professional is more important and in demand than ever before, it’s clear that the profession still has room to grow. Some sectors of the economy may have murky job prospects. However, financial planning and CFP® certification present a clear path to an ongoing and rewarding career in a growing field with the opportunity to make a real difference in the lives of everyday Americans. In fact, financial services companies have seen an uptick in hiring. According to a recent article in The Wall Street Journal, Fidelity is seeking to fill 4,000 additional jobs for financial advisors and customer-service representatives to address an increase in inquiries from customers about their investments during the pandemic.

It is no wonder then why CFP® professionals report such high satisfaction with their career choice. According to a 2019 CFP Board study of CFP® professionals conducted by Fondulas Research, 93% reported that they were satisfied with financial planning as a career choice and 92% were satisfied with their decision to pursue CFP® certification. In a sign that CFP® professionals strongly believe in the value of certification for their peers in the financial advice industry, 89% would recommend pursuing certification as a means to advance one’s career.

Financial planning also offers financial stability through achieving a financially rewarding career. The College for Financial Planning found in a survey that CFP® professionals on average earned an annual salary of $102,639 before receiving their certification. Post-certification, that figure rose to $115,002, which represents an increase of 12%. The College also found that three-quarters of all respondents said their client base grew after receiving a designation.

And financial planners who continue in their careers long-term can see sizeable compensation growth. Extensive research performed by the Aite Group in 2019 found that the average income for a CFP® professional with less than 9 years of experience is approximately $145K, but rises to nearly $297K with 15 or more years of experience.

Working in the New Normal & Maintaining Professional Career Growth

It’s no secret that the social distancing guidelines imposed by governments and companies have fundamentally changed work-life for millions of workers. According to Stanford economist Nicholas Bloom, 42 percent of the American labor force is now working from home full-time, while another 33 percent are not working and the remaining 26 percent are working in their office or other area.

This shift has been unequal in terms of its impact. Traditional office jobs have continued, albeit remotely and without the normal benefits of being in a physical office with colleagues. Because financial planning is such a client-facing profession, one might expect financial planners have faced severe business challenges. However, financial planners have adeptly changed with the times.

COVID-19, DuQuesnay posits, has pushed the industry forward 10 years in terms of technological progress.

In an Op-Ed for CNBC.com, Blair DuQuesnay, CFP®, investment advisor and financial planner at Ritholtz Wealth Management, writes that the pandemic has forced advisors to adapt and find new ways to engage with clients. COVID-19, DuQuesnay posits, has pushed the industry forward 10 years in terms of technological progress. Many financial planners have become even more accessible via video meetings, they have adopted digital paperwork and compliance programs, and they have even increased their online presence on social media channels like LinkedIn, Twitter and Facebook.

For financial planners who have integrated Fintech and other digital solutions in their planning practices, the value of technology-driven business practices has become more evident than ever, says Matthew Schulte, CFP®, head of financial planning at eMoney Advisor, writing for ThinkAdvisor. While technology is no perfect replacement for the kitchen table or living room, financial planners have the ability to meet their clients anywhere anytime, all from the comfort of their own homes.

Changing Lives and Helping Clients Navigate Times of Crisis

Watershed events like the pandemic we’re currently experiencing cause tremendous amounts of stress for consumers. Fortunately, the careers of many CFP® professionals have been shaped by navigating these momentous events — the dotcom bubble, 9/11, the Great Recession — and as a result they are uniquely equipped to bring clarity and peace of mind to clients worried about losing it all.

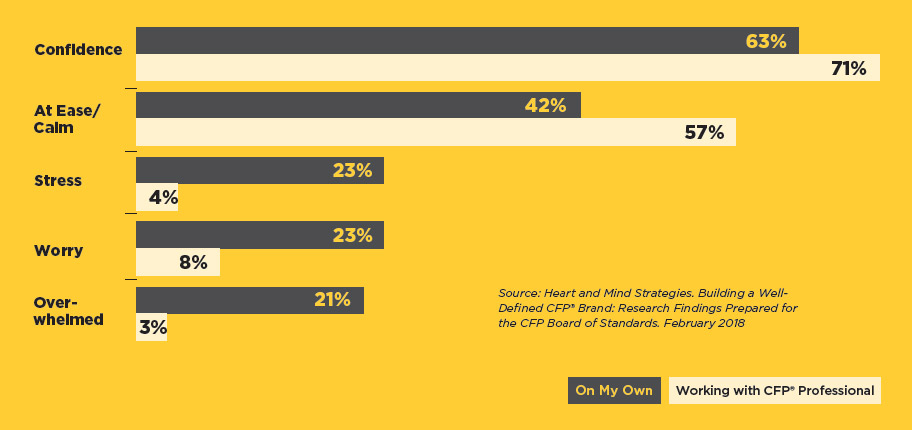

The data bears this out. In a 2018 study, Heart + Mind Strategies found that consumers working with a CFP® professional have higher confidence and feel more at ease/calm than those who are trying to go out on their own.

A similar finding from Fidelity’s 2016 eAdvisor Study showed that clients with a financial plan are 7 times happier than those without one.

Financial planners play the dual role of financial therapist and ship captain. They deliver the essential advice that eases anxiety and develop the financial plans that help their clients chart their course through the choppy waters that everyone experiences now and then, including the current uncertainty in the markets and economy.

David Zuckerman, CFP®, principal at Zuckerman Capital Management, reinforces this idea. He told CFP Board, “Remaining grounded in objectivity, statistics and probabilities of success is rarely easy during chaotic times, but it’s when a CFP® professional’s expertise can matter the most.”

CFP® professionals are able to effectively meet the needs of their clients during both good times and bad times, offering confidence for today and security for the future. But they serve as a crucial and stabilizing resource especially in times of crisis, partnering with them to navigate the most unpredictable situations when having a financial plan is more important than ever. With growing demand for competent and ethical financial advice, and an abundance of career opportunities with long-term potential, the time has never been better to pursue a rewarding career as a CFP® professional.

-

If you are considering a career path in financial planning and in pursuing CFP® certification, CFP Board offers information and resources on CFP.net to help you get certified:

Why CFP® Certification

Get Certified: The CFP® Certification Process