CFP® Certification: The Must-Have Credential for Advisors as Firms Increase Focus on Financial Planning

The shift in wealth management toward financial advice and financial planning is undeniable. From managing the change in consumer expectations to recognizing the significant value that financial planners offer, many financial firms have accelerated their adoption of business models that place a greater focus on financial planning services.

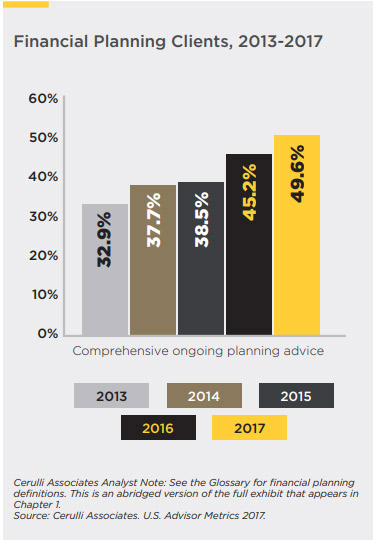

Dubbed “The Advice Revolution” by CFP Board in a 2020 report that synthesized industry data from Cerulli Advisors and Aite Group, the movement toward financial planning has been a growing wave. In 2013, financial advisors offered financial planning services to just 32.9% of their clients. By 2017, that figure increased to 49.6% — a significant jump in the number of financial plans developed.

The pandemic only increased this shift, as the financial planning profession met the COVID-19 moment by responding to a surge of inquiries from new prospects. To meet this demand, financial services firms are hiring more financial planners. Citing one example, Fidelity Investments announced in April that it planned to hire 1,000 financial planners over the next year.

As the players within the financial advice industry continue to lead their businesses with financial planning to answer the demands of a changing client base, they face questions of expertise and efficiency in hiring as they try to scale up their offerings to bring in more planning-focused clients. For financial advisors looking to fill these gaps for current and prospective employers, CFP® certification is worth considering as a must-have credential to achieve in the next step on their career path.

Ingredients of The Advice Revolution: Client Demand, Differentiation and Regulation

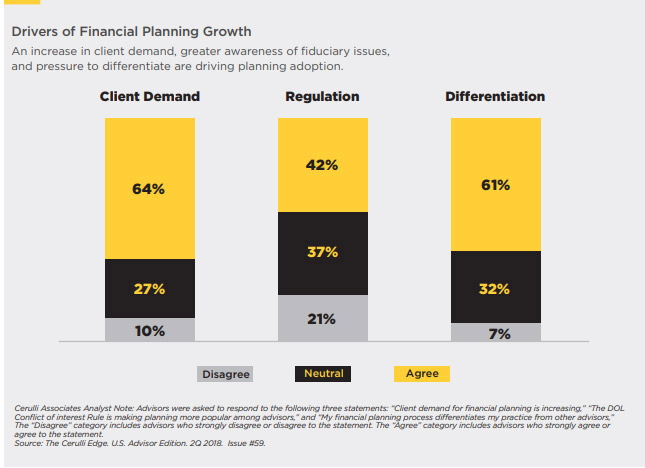

Like all tectonic shifts in industry business models, the advice revolution emerged due to several factors. Chief among them are increased client demand, differentiation and regulation.

The Changing Face of Client Expectations

According to the Cerulli study1 referenced in CFP Board’s report, more than half of investors (55%) believe advisors must take the time to fully understand their needs, goals and risk tolerance. In that same study, 64% of advisors reported that client demand for financial planning is increasing.

This trend should only continue in the current economic environment. With rising inflationary pressure, the prospect of a stock market correction, the return of student loan payments and an increase in spending that has begun to erode record-high savings rates, having a financial plan will be even more important in the upcoming year, and consumer demand for having one is likely to increase.

The types of financial services needed by Millennials, who are coming of age facing these challenges and operating from a different financial lens than their parents, go far beyond stock market tips. This next generation clientele is much more likely to have accumulated student debt, changed careers and missed out on workplace benefits such as retirement savings matching. The face of new clients is also much more likely to be female and diverse.

Advisors must anticipate that clients will not only expect expert and ethical financial planning advice, but also an understanding of the client’s motivation and the psychology driving their financial goals — and an ability to relate to the client’s own personal mindset.

Financial Planning Brings Differentiation and Client Satisfaction

Crucially, financial planning represents a way for financial advisors to differentiate their practices in an investment management space that has become increasingly commoditized. More than 60% of advisors in the Cerulli study thought that their financial planning process differentiates their practice from other advisors.

Against the backdrop of robo-advisors, commission-free trading, auto-balancing and investing, sound financial planning stands out from the pack — and the results speak for themselves. Consumer research conducted by Heart + Mind Strategies in 2020 found that 84% of those working with a CFP® professional are extremely or very satisfied with their advisor’s financial advice competency, compared to 72% of those working with a non-certified advisor.

Regulatory Pressures Push Advisors and Firms Toward Financial Planning

On the regulatory side, the increased focus on the fiduciary standard as a result of the public discourse around the Department of Labor’s (DOL) dropped fiduciary rule and the more recently implemented Regulation Best Interest have led firms down the road of financial planning. According to the same study from Cerulli, 42% of advisors agreed that the DOL Conflict of Interest Rule is making financial planning more popular among advisors. Per the report, “Financial planning that demonstrates a clear strategy for overall financial success, strong analysis and thorough documentation of every step can be an effective way for advisors to demonstrate that they are acting in their clients’ best interest.”

Meeting the Moment: CFP® Certification Unlocks Financial Planning at Scale

Crafting a financial plan for a client requires expertise, experience and attention — there’s no cookie cutter approach, as each client has their own needs and priorities. Advisors looking to scale up their financial planning services will want to ensure their clients receive plans that have been given the utmost care, while also remaining timely and efficient to produce.

In a recent blog post discussing scaling the delivery of financial advice to address client demand, Michael Kitces, CFP®, Head of Planning Strategy at Buckingham Wealth Partners, perfectly explains the value proposition of the knowledge embedded in CFP® certification to firms: “Expertise that is learned once, definitively, provides ongoing time savings for every client thereafter.”

Within his research, Kitces and his team specifically examine the difference in productivity between CFP® professionals and financial advisors without the CFP® certification. In a top-line analysis, the research revealed that the average CFP® professional needs just 32 hours to construct a financial plan, while the average advisor without CFP® certification takes more than 41 hours to engage in the same process.

Clearly, CFP® certification enables financial planners to serve clients effectively and efficiently at scale. As the wealth management industry continues to focus on financial planning to address client needs, it stands to reason that demand for CFP® professionals will increase to support firm growth. As a result, firms will be looking to hire CFP® professionals to meet their goals, further reinforcing why the CFP® certification is the must-have credential for financial advisors.

1. The Cerulli Edge. U.S. Advisor Edition. 2Q 2018. Issue #59.