Successful Succession

After years of building a personal and trusted relationship with their advisor, clients might feel uneasy working with a new, often younger, advisor. Arming the next generation of advisors with a well-respected and highly recognized credential will establish trust and credibility with experienced clients, create a seamless succession, and keep those clients right where they are.

Some of your firm’s clients may be in year 20 of their relationship with their advisor. Over years they’ve become very comfortable with their specific advisor’s personality, skillset and approach to financial planning. As a result, they might even have referred friends and family to their firm, knowing that their referrals would receive the same excellent client experience. As the advisors at your firm approach retirement, you are confronted with a potential problem: how will those clients react to a handoff to another advisor that does not have the same personality, skillset and approach to financial planning.

Within the next 10 years, Cerulli anticipates that nearly 40% of the financial services industry’s assets will be in transition because of advisor retirements.

Firms may need to plan for this scenario much sooner than they think. According to a 2021 report from Cerulli, the average age of an advisor is 51 years old, and they have nearly 20 years of experience in their profession1. The report also states that advisors aged 55 to 60 manage 34% of the total assets under management. In contrast, advisors who are younger than 35 years old make up just 12% of advisor headcount and represent just 7% of assets under management. Within the next 10 years, Cerulli anticipates that nearly 40% of the financial services industry’s assets will be in transition because of advisor retirements. That means roughly $10.4 trillion will move from a skilled, experienced, and respected financial professional to someone else.

What is being done to ensure that clients feel secure and satisfied during the transition from one of your firm’s advisors to another?

CLIENT EXPECTATIONS

Our article from February discussed client retention by focusing on the client experience; knowing what the client wants from their advisor and their firm and then “meeting the client where they are.” To truly understand the unique needs of each client one must understand the key factors of the client experience.

For example, does the client simply want advice on financial decisions that they ultimately make independently? Or are they looking for a financial professional who takes a more comprehensive approach, analyzing all part of their financial picture and providing holistic recommendations? Knowing how clients want advice delivered is a key component of creating a satisfying client experience. Would the client be most likely to act on advice given in-person or would they rather receive “digital advice,” using virtual meetings and collaborative, online modeling software?

The expertise of the advisor obviously plays into client experience as well. If clients have worked with an experienced, well-trained and highly credentialed advisor for years, it stands to reason that maintaining continuity in those expectations is necessary for a successful transition as their advisor retires. As retiring advisors introduce their successor, clients will immediately recognize that they are losing the experience of their more tenured advisor. Therefore, your firm and the successor will need to maintain the trust of the client through training and credentials.

A TRANSITION USING A TEAM

We’ve all noticed and probably been a part of the evolution of single-person shops — where the advisor handles all aspects of the client relationship — to a team model. Although not every solo practice may choose to adopt this model, the “Teaming” approach can help create a natural plan for business continuity, as long as it is done with business succession in mind.

When applied in a wealth management setting, teams typically highlight natural inclinations and individual skillsets, making the team more productive.

When applied in a wealth management setting, teams typically highlight natural inclinations and individual skillsets, making the team more productive. Team members often bring their own specialties and work with clients in different capacities (i.e., planning, investments, insurance, operations, etc.). Teams constructed in this manner can function highly effectively and very efficiently. While all team members are fully capable to handle more than their specialty, each one will obviously become very skilled in handling the specific issues within their area of concentration. Clients react well to this and will readily identify and appreciate the team’s proficiency within each area. Clients will also continue to recognize the lead advisor as just that — the leader, the one expert in all areas.

As discussed in our previous article, “ Solving the Trust Problem,” clients trust their advisor based on the belief that they can deliver high quality work, “Competency Trust,” and the belief that the advisor has good intentions and high integrity, “Interpersonal Trust.” Lead Advisors of teams earn both types of trust. In many cases, clients have been with the lead advisor for their entire working career, they have seen the evolution of the practice and have provided many referrals, contributing to the growth of the business.

Teams built around siloed specialization can earn the interpersonal trust of the clients through actions that demonstrate to the client that they are working in the client’s best interest. Team members can also earn clients’ competency trust, but only within the perceived specialties. If the client values the skills a team member brings related to portfolio construction, they may not feel comfortable with advice they receive from that team member outside of their specialist role. Teams designed to build businesses can also be missing some elements vital to seamless business succession.

This team structure is very common. As firms prepare for the transition of a wide swath of their retiring lead advisors, they should pay special attention not only to the skills of those on the team, but also to the client’s perceptions of the skills of the team members who are expected to assume the future lead advisor role. But how will clients know that the succeeding advisor has been educated and trained, proving that they are competent to handle their new, expanded role? That brings us to certification.

CERTIFIED CREDIBILITY

The financial planning profession, along with many other professions and industries, sits at the beginning of an anticipated decline in expertise because of an aging workforce. This expected decline unfortunately outpaces the number of prospective financial planners entering training programs, further exacerbating the issue. Not unlike the current supply chain crisis, this talent shortage comes amid an increase in consumer demand for financial advice.

More people leaving, fewer people entering and more clients asking for financial planning and holistic advice services are compelling reasons for firms to take a proactive approach to conserving client relationships. Thoughtful, intentional succession efforts will go a long way in accomplishing this.

Approximately 47% of the 92,000 CFP® professionals in the United States are over the age of 50. Over the next 10 to 15 years, these experienced, credentialed financial planners will transition their client relationships to the next generation of advisors. What will that mean to your clients and your firm if the next advisor is less credentialed, or worse yet, not credentialed at all?

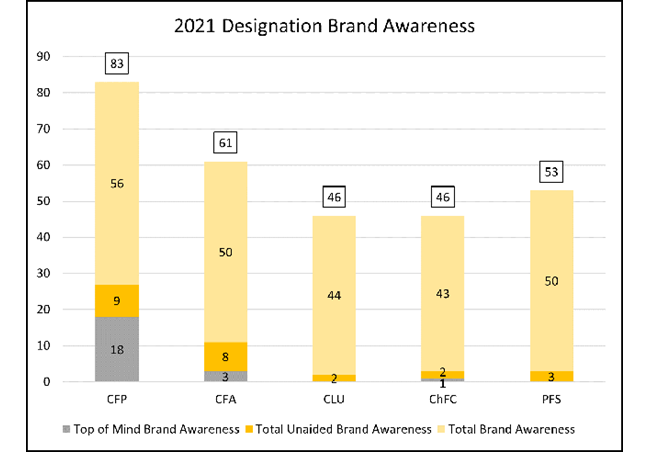

Thanks to the good work of these 92,000 CFP® professionals and CFP Board’s Public Awareness Campaign, the CFP® certification has become widely recognized by consumers.

An advisor with the CFP® certification behind their name demonstrates to the client their level of experience as well as the ethical and conduct expectations they are required to uphold. Replacing the decades of advising experience that may leave your firm within the next few years while maintaining the great client relationships these advisors have built will be challenging. Arming the next generation with a well-respected and highly recognized credential will be essential in maintaining the competency trust factor and keeping those clients right where they are.

1. The Cerulli Report, U.S. Advisor Metrics 2021

Interested in discussing how CFP Board can support your firm’s certification efforts? Contact CorporateRelations@cfpboard.org.