Training for the “Personal” in Personal Financial Planning

Client financial situations are inextricably linked to their personal situations. Firms and advisors must recognize this crucial link and how it can affect — both positively and negatively — client outcomes in order to provide better planning services. With the release of Psychology of Financial Planning, today’s CFP® professionals have access to a body of knowledge that addresses the wide scope of skills needed to better deliver plans that clients will implement.

For many decades now, the model for onboarding, training and developing new financial advisors has not changed much. Rookie advisors must pass requisite licensing exams when first hired; they must familiarize themselves with the firm’s culture, business, compliance, products and services; and finally, they receive training on obtaining clients and working with them to agree to a financial plan and implement its recommendations. Typically, firms compress this learning for their new advisors in the first six to 18 months. For advisors at many firms, they follow this training phase with the pursuit of rigorous certifications, such as the CFP® certification. It is a lot to learn, but many will still not succeed after a few years even with all this training.

Why? You would think these advisors, who are armed with extensive knowledge about their firm, its products and services, and how these products and services can solve client’s financial problems, should be able to service, build and retain happy clients who feel all their financial needs are being met and their financial well-being is being satisfied. But when the advisor takes their hard-earned knowledge and skills and start working with real human beings, they quickly confront reality. They find out that not all clients have the same beliefs about money, risk, caring for their loved ones and how to make good financial decisions. They are confronted by individuals who become angry and immediately distrustful when the market rapidly falls. Advisors also may never realize how their own biases and beliefs about money play an important role in what they recommend to their clients. These examples represent just a few of the myriad of situations that new advisors face in the field that don’t come with an instruction manual in their firm’s training. Some eventually learn through experience over years and adapt by better communicating and coaching their clients through these difficult situations. Others don’t learn these skills and unfortunately never become the great advisors they might otherwise have become.

These skills, fortunately, can be taught.

The Psychology of Financial Planning

CFP Board recognized this early, and published Communication Essentials for Financial Planners (2017) and Client Psychology (2018). In 2021, CFP Board completed its periodic Job Task analysis (performed every five years) and identified the Psychology of Financial Planning as a critical new learning domain. As a result, this new domain is now part of the education, exam and continuing education for all CFP® professionals. CFP Board then set out to build a body of knowledge around this skill which it defines as:

Identifying and responding to attitudes, behaviors, and situations that impact decision-making, the client-planner relationship, and the client’s financial well-being.

In 2022, CFP Board released the book Psychology of Financial Planning which is made up of six principal knowledge topics, covering both existing education requirements and new topics. Sources of Money Conflict and Crisis Events with Severe Consequences were identified as two areas that were especially critical and not previously covered by the body of knowledge. More importantly, this reference book is both research-driven and practitioner-focused. Which is to say that it is not meant to be theory only for academics, but rather a resource for advisors to reference and apply to support their daily interactions with client situations.

Equipped with this resource, advisors can enter an initial client meeting with many of the skill sets that are critical for this stage of the process: asking questions, listening, learning about more than the client’s goals — but also their beliefs about money, and the challenges they are facing in their own lives. They will better use other skills such as empathy, probing (when necessary), and providing information the client will need to develop trust and confidence in their ability to achieve their financial goals.

How the Psychology of Financial Planning Will Be Trained

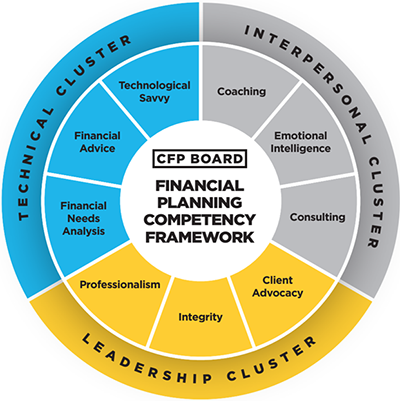

The CFP Board now includes the skillsets of the Psychology of Financial Planning as part of its Financial Planning Competency Framework in the Interpersonal Cluster, which is one of the three key “clusters” that are now part of the education, exam and CE requirements:

- Technical (Financial Advice, Financial Needs Analysis and Technological Savvy)

- Interpersonal (Coaching, Emotional Intelligence, and Coaching)

- Leadership (Professionalism, Integrity, Client Advocacy)

The CFP education, exam, and CE programs will all use this framework. Although the education and exam will address the need for new CFP® professionals to have these skills, the book (along with CE programs that already exist and are being developed) will enable firms to “backfill” these skills for their existing advisors. CFP Board also expects to release a Practitioners Guide (currently in development) that will further help advisors incorporate these practices into their daily routine with clients.

Those are the resources, but how will this be done in practice?

First, the advisor will need to learn the concepts embedded in the nexus of psychology and financial planning, so they can understand, recognize and identify certain behaviors with themselves and/or their clients. Representative concepts include Risk literacy, Money Scripts, Goal Congruence, and Financial Self-Efficacy.

Then the advisors will gain tools he or she can rely on to help determine the client’s money beliefs, and their willingness to change, which this new domain provides to advisors. There are also tools to help clients develop a sense of control, confidence, competence and autonomy around their financial affairs. To help deliver this counseling and coaching, advisors will be equipped with communication techniques to help advisors defuse emotional situations so that clients can better make sense of their choices and be willing to take advice that will help them achieve their goals.

A major objective of this book is to take the theory down to a practice level. As the authors state in one passage about client/advisor disagreements:

“The advisor wants the client to save the bonus, and the client wants to spend it. The advisor thinks paying down the debt is most important, but the client feels that starting a college savings plan is more important. The advisor wants the client to diversify, and the client wants to buy more of their own company stock. The examples are nearly endless, and the answer is not as simple as ‘the customer is always right’ and thus simply giving in to the client.”

The book’s use of these examples in case studies will demonstrate when and how to apply the right methodologies, depending on the client situation.

Benefits for Firms

The training firms provide today is not adequate for the task at hand, leaving advisors to learn on the fly. Investing in this body of knowledge will provide more scalable benefits for firms and help retain advisors and their clients. Firms recognize the value of improving the client experience and are making large investments in technology to improve that experience. Adding behavioral coaching skills and emotional intelligence will be a crucial addition to the client’s perceived experience with the advisor and firm.

The opportunity for firms and their advisors is based on a simple premise: the knowledge and skills of this new domain will complement the technical knowledge advisors receive in the first few years of their career and through their CFP® certification education.

While technology enhancements can make elements of an advisor’s job more efficient, only a human financial advisor can understand human beings. In short, the Psychology of Financial Planning focuses on the crucial aspects of an advisor’s job that technology cannot replace: discovering goals, fears, anxieties and beliefs about money; applying listening, questioning, coaching and empathy to communicate to the client that they are being heard and the advisor is taking those concerns and issues into their planning recommendations.

The opportunity for firms and their advisors is based on a simple premise: the knowledge and skills of this new domain will complement the technical knowledge (e.g., retirement planning, investment advice, estate planning, tax planning) advisors receive in the first few years of their career and through their CFP® certification education. These “soft skills,” as some have described, will enable advisors to better communicate with clients, establish trust, build confidence in clients and help frame financial decisions in a way that enables clients to make good decisions. In addition, advisors will become more self-aware of their own beliefs and biases and how to mitigate any negative effects on their financial planning recommendations.

All of this will translate into better outcomes for the client. Advisors trained in the Psychology of Financial Planning should start to see more clients share their personal and financial information, implementing their financial plans, and better resolution of conflicts between family members (and the advisor). These outcomes will be the result of an increased focus on understanding clients, helping them articulate their goals, framing their decision-making, and helping them overcome their resistance to change.

As the book states, client financial situations are inextricably linked to other situations, “human drama and frailties; religion and spirituality, death, family dysfunction, illness, divorce, and depression.” The time has come for firms and advisors to recognize this crucial link and how it can affect — both positively and negatively — client outcomes. The good news is that today’s CFP® professionals have access to a body of knowledge that addresses the wide scope of the skills needed to create financial planners who are better equipped and will be better able to deliver plans that clients ultimately implement and use to help them achieve their life goals.

Interested in discussing how CFP Board can support your firm’s certification efforts? Contact CorporateRelations@cfpboard.org.